June 13, 2023

The OpenFin Ecosystem: Harnessing the Full Power of Fintech Innovation

Short-Term Disruption

Is innovation dead? A major bank failure, ballooning inflation and interest rates, escalating geopolitical tensions and the aftershocks of the COVID-19 pandemic have all been pointed to as death tolls for industry development, tech budgets and startups. Meanwhile, although interest in fintech modernization remains strong, there may be more trouble ahead: recent events could be the harbinger of a more challenging environment.

Still, in the face of rising economic challenges, capital markets innovation today continues to accelerate among scrappy fintechs, large technology vendors and major financial services firms alike. In fact, 2021 and 2022 were the largest years on record for global fintech investment, with a combined $220.2 billion poured into these efforts, according to Innovate Finance. While later-stage funding decreased in 2H 2022 due to macroeconomic conditions, seed rounds were actually up 30% over the full two-year period.

What does that mean? It means that the system has the foundations and support it needs to continue to flourish on the whole. Despite mounting global pressures, we’re currently experiencing a rapid revolution that can only be adequately described as an innovation supercycle—and we at OpenFin, alongside our industry colleagues and partners, are helping financial services firms take full advantage.

Firms are focusing their innovation for the long haul—many of the original fintechs that rose to prominence in the last two decades have grown and matured as businesses, yet continue to thrive as innovators, leveraging the latest technology to build or refine game-changing systems. Meanwhile, established firms continue to support innovation with structures to further drive modernization, including VC arms (Barclays and Standard Chartered) and centers of excellence (JP Morgan). BlackRock, whose technology revenue now comprises 8% of overall profits, reported a 6% year-over-year increase in annual contract value for Q1 2023. The persistence of technological innovation despite larger economic challenges is further demonstrated by the exponential growth of many firms, including several OpenFin partners—BMLL, Droit and LeapXpert have all secured successful funding rounds in recent months.

This innovation is touching every corner of the capital markets, and fixed income is no exception. From enhanced bond trading platforms to accelerated bond trading workflows to easier access to relevant data and analytics, this asset class has been powerfully impacted by technological advancement. As we prepare to spend a week engaging with these innovators at the Fixed Income Leader Summit, we are looking forward to getting an early look at what’s next in this sustained wave of innovation.

Government support for technological innovation efforts has also endured. Actions on both sides of the Atlantic surrounding the recent Silicon Valley Bank crisis have demonstrated unwavering support for the fintechs affected. Meanwhile, organizations like the UK’s Center for Finance Innovation and Technology (CFIT), launched in late February with funding from the Treasury and City of London, have made it their mission to help the fintech sector realize its full potential. Prime Minister Rishi Sunak has set out ambitious growth plans for fintech, signaling a commitment from the highest levels.

Preparing for the Future

The party isn’t anywhere close to over, as evidenced by the momentum above, but industry business and technology leaders must prepare for the tide to turn at any moment. To weather all of these challenges, they must be highly intentional in their approach.

First, they must move away from pursuing innovation for its own sake. In the face of economic pressure, it’s crucial that every technology investment be geared toward directly addressing key challenges and pain points while delivering business outcomes. Likewise, firms must become better at adopting innovation quickly, with a particular focus on improving their processes around fintech onboarding, business sign-offs and sharing solutions across company divisions and regions. In fixed income, which is seeing an influx in interest from the retail community, these are especially important priorities. Ditto for options, crypto and other emerging asset classes.

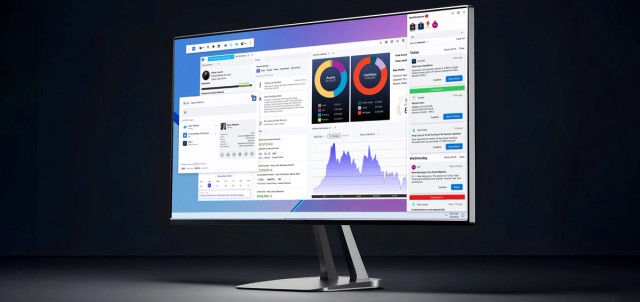

One more piece of the innovation puzzle is for firms to do more with the tools they already have at their disposal—but what exactly does that look like in practice? The financial desktop is a great place to start. In an environment where fragmentation between a wide range of proprietary and third-party apps can cause great friction, a unified desktop experience, with easy navigation and the free flow of data across contexts, is crucial to maximizing productivity. Instead of replacing underutilized software, firms should look at levers to improve consumption and return on existing investment.

An Ecosystem Approach

By enabling seamless interoperability between disparate apps, OpenFin powerfully alleviates the everyday frustrations of end-users, empowering them to carry out tasks without the tedium of tracking down the right window or rekeying information. We deliver everything from configurable browser layouts to actionable notifications, serving as a unified space for all desktop functions. Our extensive track record in delivering these efficiencies enables firms to keep pace with both the diverse needs of their clients and the markets at large, putting us in a natural position to prepare for an uncertain future.

But to win this innovation arms face, desktop productivity tools alone won’t be enough. To truly thrive, an industry-wide approach is required. We’ve been active on that front, leading the formation of the industry standard FDC3, a set of building guidelines that ensure interoperability is baked into all compliant systems. Today, major banks (including BNP Paribas, Goldman Sachs, JPMorgan, Morgan Stanley and UBS), tech vendors and investment managers have leveraged our desktop solution to build next-generation solutions or empower their employees. That requires critical thinking about an app’s role in a given workflow, as well as reducing barriers to adoption by emphasizing transparency and accessibility.

OpenFin was founded with the goal to help the financial services industry solve universal productivity challenges—and nearly 15 years later, we’re proud to have made good on that mission. Our award-winning OS has created a unifying technology layer for some of the biggest names in the industry, streamlining end-user processes within increasingly complex desktop environments. Along the way, we’ve unleashed an extensive set of workflow management tools in the form of our Workspace product, and we’ve built up a broad partner ecosystem of major banks, brokers, buy-side firms and technology vendors from around the world.

We’re constantly learning from each one of our clients and partners, and we put these findings to work to create further efficiencies for all. Our quest to maximize the financial desktop has led to the growth of a powerful ecosystem of innovative apps spanning all corners of the industry. Continuing to deliver these workflow efficiencies solidifies our pivotal role in fintech’s hypergrowth, as well as any possible downturn.

The future may be uncertain, but the pressure to employ modern workflows will always exist. By providing a framework through which innovative apps from across the industry (both internal and external) can be leveraged in concert, we remain ideally positioned to drive the next phase of modernization, whatever it may look like.

Enjoyed this post? Share it!

Related Posts

All Posts ->

Featured

Enhanced Deployment Flexibility with OpenFin's Fallback Manifests

Thought Leadership

Featured

ING Integrates OpenFin for Salesforce to Optimize Workflows

Thought Leadership